Nirmala Sitharaman, PM Modi, Budget 2023

A simple capital gains tax regime helps investors to understand and plan for tax costs while deciding on the investment.

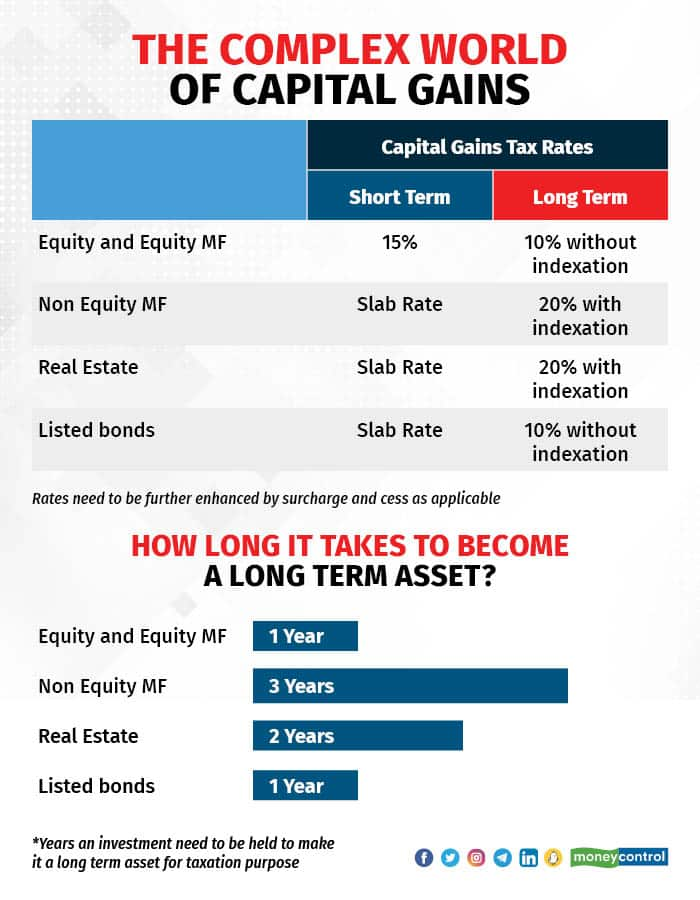

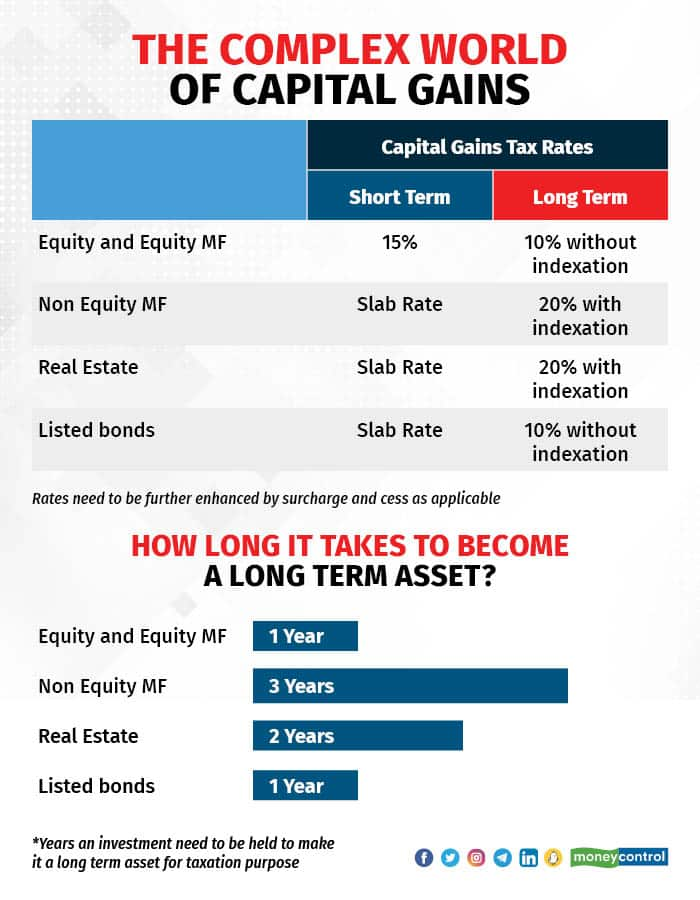

The current capital gains tax regime in India is complex. The holding period to identify whether the capital gains earned is a long-term gain or short-term gain depends on the asset and the rate of taxes (see graphic).

Capital gains tax rates and threshold to determine the long-term tax relief are different across investments.

Capital gains tax rates and threshold to determine the long-term tax relief are different across investments.

Indexation benefits are also asset-specific. With Budget 2023 round the corner, investors are hoping for a simpler system, which would be easy to calculate tax costs and minimise litigation and disputes.

Clearly, there is a need to simplify the provisions and minimise complexity. Here are some expectations from Budget 2023:

Shorter holding period for non-equity mutual funds

As against the current three categories of holding period, the expectation is that this will be simplified to at least two categories.

For instance, capital gain on listed shares is considered as long term, if the holding period is 12 months. REITs (Real Estate Investment Trusts) and InvITs (Infrastructure Investment Trusts) are categorised as long-term capital assets, if held for at least 36 months.

To bring parity into tax treatment, and for the computation of capital gains tax, the holding period for units of REITs and InvITs should be standardised at 12 months, instead of 36.

On similar lines, the holding period for non-equity mutual funds may be brought down to 24 months to qualify as long-term asset.

Non-taxable limit on equity LTCG

Long-term capital gains (LTCG) from the sale of listed equity shares and units of equity-oriented mutual funds are taxable, if the gain exceeds Rs 1 lakh per annum.

This provision was introduced through the 2018 Finance Act, to encourage investments in diversified assets beyond listed equity shares and equity-oriented mutual funds.

This category of long-term assets have enjoyed total tax exemption since 2004, since these transactions were subject to Securities Transaction Tax (STT).

While the withdrawal of STT appears unlikely, the expectation from retail investors is that the non-taxable limit of Rs 1 lakh per year could be increased to at least Rs 2 lakh.

Enhance rebates and deductions

Capital gains from the transfer of land or building is exempt to the extent it is invested in government of India-specified bonds, subject to a ceiling of Rs 50 lakh.

One of the expectations from the budget is that this limit will be enhanced. Further, this benefit may be extended to all LTCG long, instead of limiting it to only gains on sale of land or building. This step will also encourage investments in infrastructure bonds.

The current regime does not entitle taxpayers to the rebate (of up to Rs 12,500) on tax payable on LTCG on the sale of listed equity shares, equity-oriented mutual fund units and units of REITs/ InvITs, which should be permitted.

Simplifying the complex capital gains tax regime in India ranks high among expectations from Union Budget 2023. It can cheer up taxpayers and ensure sustained investor interest.

(Saraswathi Kasturirangan is Partner, Deloitte India. Vijay Bharech is Director with Deloitte Haskins & Sells LLP. Priyanka Bhutada, Manager with Deloitte Haskins & Sells LLP also contributed)

Capital gains tax rates and threshold to determine the long-term tax relief are different across investments.

Capital gains tax rates and threshold to determine the long-term tax relief are different across investments.