In Graphic Detail: Bank credit to industry rises, a lure for private capex

In Graphic Detail’ is a special series of data stories covering the Union Budget's key elements over a short and long-term period

January 18, 2023 / 06:38 PM IST

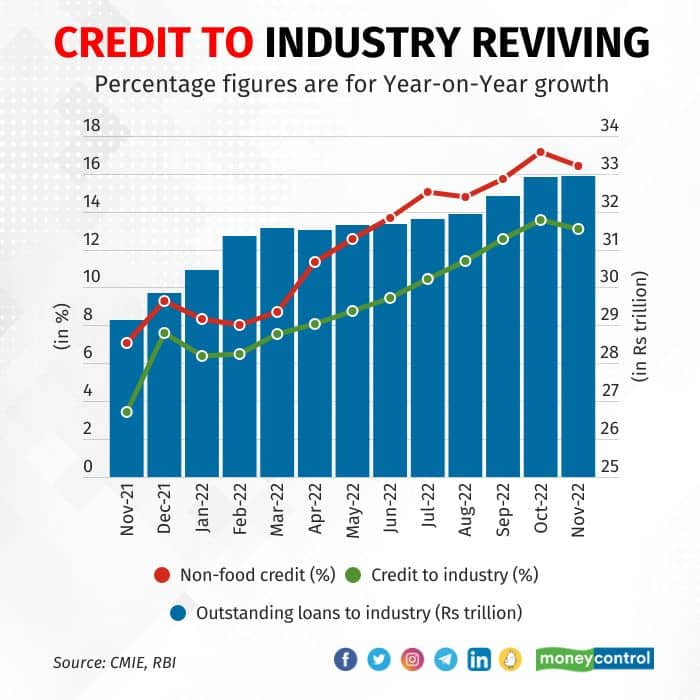

Loans to industry as a percentage of nominal gross domestic product have dropped sharply over the past seven years, an indication that India’s businesses didn’t really contribute much to economic growth.

The story of private sector capex usually starts with the state giving it a push and then the financiers chasing big companies with loans to add the final shove. The government’s capex mill is running faster, as we highlighted in an earlier edition.

Also Read: In Graphic Detail | How government's capex got a boost in recent years

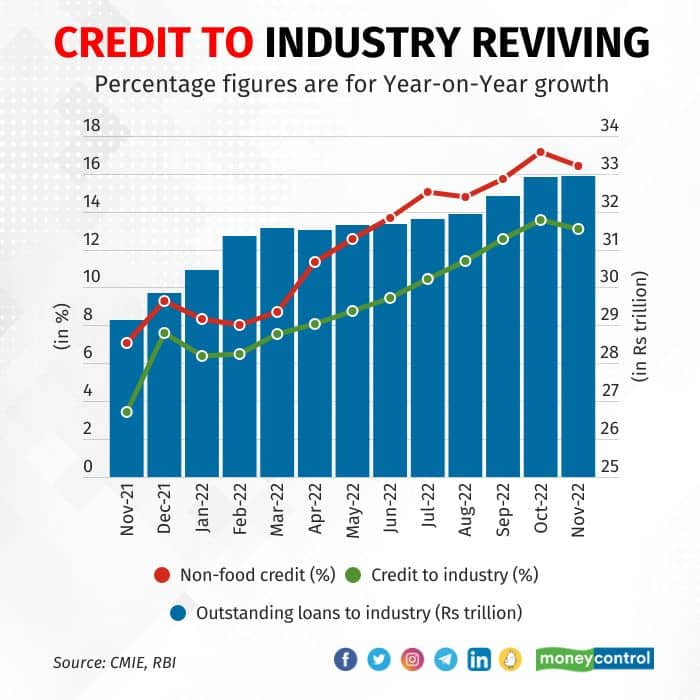

Now the financiers have also begun to add their weight to coax the private sector to spend on capital and begin setting up factories and fresh capacities. As the chart above shows, bank credit to the industry has shown an impressive revival over the past one year and seems to be holding its own in contributing to the recent surge in credit growth. From being an abysmal 3.4 percent year-on-year growth in November 2021, loan offtake to industry has quickened to 13.07 percent by November last year. While retail loans may still be growing at a faster pace than the overall loans of the banking sector, lending to industry is beginning to hold its own. The fact that a large part of the growth has come from lending towards large companies is another reason for cheer.

Borrowing by big companies tends to translate to increased orders down the supply chain to smaller players. The trickle-down effect in credit would eventually lead to small businesses borrowing to meet an increase in business which sets off a virtuous cycle of capex.

That said, loans to industry as a percentage of nominal gross domestic product have dropped sharply over the past seven years, an indication that India’s businesses didn’t really contribute much to economic growth. This trend has stabilised post FY20 as the chart above shows. For FY23, loans to industry was roughly 12 percent of nominal GDP up to first half of the fiscal year. Given the trend in credit growth, it is likely that this would surpass the previous year considerably. That should be taken as another sign that private capex has everything in place to return strongly. There is all the more reason for the Union Budget to continue with its thrust on capex for another year.