Public sector enterprises may look appealing to investors, but not many are willing to take a bite of those in the divestment list. (Representative image)

Months before the Union Budget, stock market enthusiasts and analysts flag off select themes to alert investors of sectors and companies that could mint returns for them based on expected policy announcements. But disinvestment as a theme hasn’t had much enthusiasm.

The blame lies with the government and its past unmet disinvestment targets. Unfavourable market conditions meant that even big names such as Life Insurance Corporation (through an initial public offer) couldn’t garner more cash for the government. The Centre is set to miss the divestment target again in FY23.

Analysts believe that given the political compulsions ahead of national elections in 2024, the government would prefer to conclude the pending stake sales by removing the obstacles to these rather than go for big-bang sales. In the probable candidate list are BPCL, Central Electronics, Container Corporation of India Ltd (Concor), Rashtriya Ispat Nigam Ltd, BEML, IDBI Bank Ltd, Shipping Corporation of India Ltd, and minority stake-sales in Hindustan Zinc Ltd. Besides these, other piecemeal asset sales such as of NMDC’s steel plant and SAIL’s steel plant would also be looked at.

"The government's proposals of privatising two PSU banks, state-owned oil company BPCL, select steel plants, and infra assets (airports, railway stations, etc) have seen limited movement in 2022, and appear unlikely to see a serious push in 2023,” analysts at Jefferies India Pvt Ltd wrote in a note.

ALSO READ: Budget 2023 seen pro-growth, prudent, not so populist: Survey

“We expect that barring PSUs where the privatisation/disinvestment process is already ahead and largely non-contentious, Concor, IDBI Bank, BEML, and Shipping Corp could be among the few to see progress; that too not beyond 1H23,” the note said.

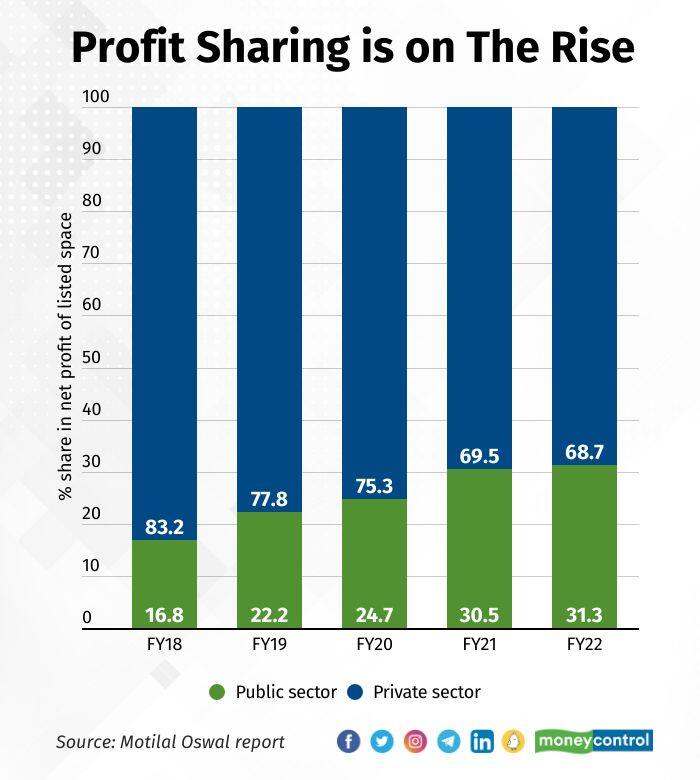

However, analysts at Motilal Oswal Financial Services Ltd say that despite a desolate past, things are looking up for public sector enterprises. They point out that the profit pool of public sector undertakings (PSU) has steadily grown.

“As we look ahead, the profitability of PSUs is shooting up across domestic as well as global cyclicals, with turnaround in the fortunes of PSU banks driving the overall trend. Higher commodity prices over the past two years have aided the P&L and balance sheets of Metals/O&G PSUs,” analysts at Motilal Oswal Financial Services pointed out in a report.

Worthy buys or lame ducks?

Public sector enterprises, as a group, may look appealing to investors, but not many are willing to take a bite of those in the divestment list. This is evident from the fact that these companies have been on sale for at least two years now. Their market valuations have moved largely in tune with their operating performance.

BPCL’s divestment was first announced in 2019 and the government then invited bids a year later. But the pandemic-induced surge in global oil prices and the resulting losses for BPCL prompted a rethink by investors and the divestment was finally called off in May last year. Oil refining and marketing firms, such as BPCL, logged losses in the past two years owing to a surge in under-recoveries. BPCL reported a massive net loss of Rs 7,377 crore in the first half of FY23. It also reported an operating loss for the period and its profit margin reduced to 1.37 percent as of September. Analysts expect the operating environment for oil marketing companies (OMCs) in general to be challenging in the coming year as they would have to deal with elevated oil prices and the political pressure to avoid hiking retail fuel prices ahead of elections. BPCL’s market valuation has taken a 10 percent hit over the past one year, in contrast to the 5 percent gain in the broader Nifty 50 during the same period.

For Concor, the picture is far better, as the company reported a decent set of operating metrics for the December quarter. The firm reported a 14 percent year-on-year (YoY) growth in operating profit and an improvement in profit margin to 21.4 percent. The outlook for 2023 is sanguine for the logistics sector and analysts see privatisation as a key trigger for Concor’s rerating. According to analysts at Jefferies, Concor is an easy candidate to divest as the company is net-debt free and a major player involved in railway logistics. Further, its cash flows have strengthened in recent years. “Volume growth should drive the upside for Concor over the next 6-12 months, with privatisation being an important trigger,” they wrote in a note.

IDBI Bank’s privatisation has been tricky and has been partly addressed through the government’s stake sale to LIC. This may have technically earned IDBI Bank the moniker of a private sector lender, but it isn’t perceived by the market as such. The bank’s cleaned up balance sheet, optimistic growth outlook for the current and next year, and the strong prospects for the sector have made investors receptive to the government’s divestment offer. The lender has brought down its bad loan pile sharply. It swung to a net profit in FY22 after five consecutive years of losses. The bank’s valuation too has moved in tandem with the improvement in performance, gaining more than 6 percent over the past year.

Mid-cap company BEML’s shares have tanked more than 15 percent over the past year and the company’s revenue and net profit were down roughly 20 percent YoY for the September quarter. The maker of heavy construction and logistics equipment has seen a sharp decline in revenues this year and prospects do not seem bright.

Shipping Corp’s net profit has nearly halved from the year-ago period although the cargo carrier has shown resilience in revenues. “Small and mid-cap PSEs will be on offer in terms of divestment. But whether it would change the fortunes of these companies is not clear yet,” said an analyst at a brokerage firm.

The proceeds from the disinvestment of these companies would go to the shareholder: the government, and the firms won’t get any funds as capital. To that extent, the immediate impact of divestment on operating performance is unlikely to be significant. That said, the divestment process is seen as unshackling these companies from inefficiency and lethargy that seem to characterise public sector entities. Prima facie, the exit of the government from sectors would encourage private investment, and therefore profitability, as the focus of a private enterprise is profits, while public firms tend to prioritise social welfare. Analysts believe that more than disinvestment, sector-specific measures and improving outlook would help the firms more. For instance, Concor’s prospects are brighter owing to the expected push for infrastructure and railways. Jefferies has put Concor in its preferred picks for PSU stocks because valuations still have room to rise given the earnings per share (EPS) estimate improvements.