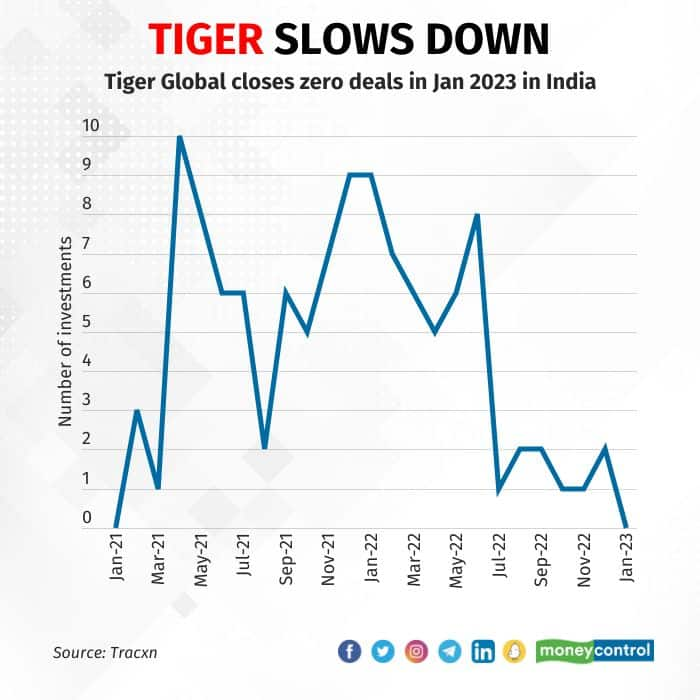

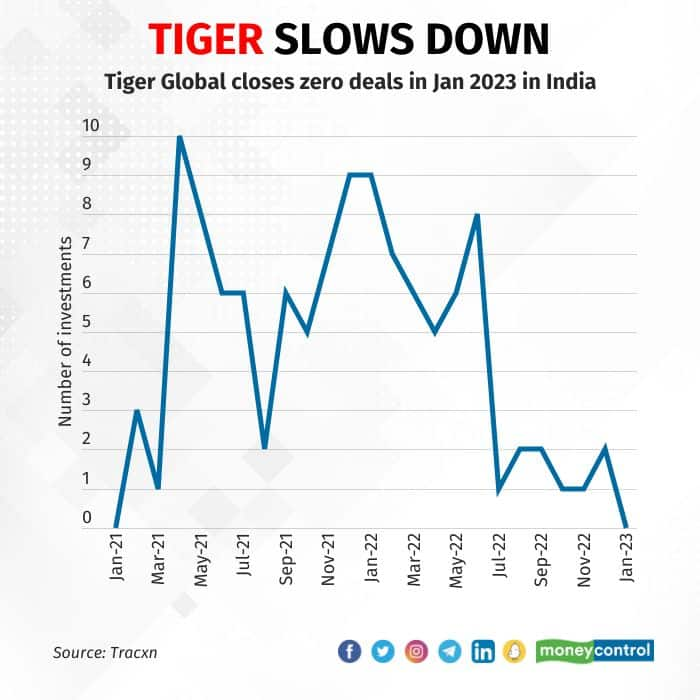

Tiger Global Management, one of the most prolific private market investors in India, did not invest in a single startup in the country in January 2023, indicating a worsening funding winter for the world’s third-largest startup ecosystem.

This was the first time in two years that the firm has skipped investing in an Indian startup in a month. The last time this happened was in January 2021.

The New York-based hedge fund participated in nine funding rounds in India in January 2022, according to data compiled by Moneycontrol through Tracxn. Globally, it participated in two funding rounds in January 2023 – both outside India – against 49 in January 2022 and 17 in January 2021, the data showed.

While Tiger Global closed only four deals in the last quarter of 2022, the hedge fund investor participated in an average of about four deals a month in 2022, the data showed. Tiger Global invested in 50 funding rounds in 2022, while it participated in 63 funding rounds in 2021.

Tiger Global did not respond to queries sent by Moneycontrol.

The firm has been an aggressive investor in India and has backed close to 40 of the country’s 107 unicorns. The hedge fund turning cautious and going slow on investments suggest a painful period for startups in the country that thrive on private equity and venture capital funding.

More importantly, Tiger Global has been “extremely bullish” on India’s startup ecosystem even as peers have turned very cautious. In 2022, partners of the hedge fund visited India at least four times to meet early-stage investors and explore investments, Moneycontrol reported.

Media reports have suggested that Tiger Global would invest “largely” in Indian startups through its new $6 billion fund, which it is yet to launch.

Tiger Global’s investment numbers for 2022 second its bullishness on India. In 2022, its investments, in terms of volume, dropped 20 percent from a year earlier, unlike its peers. SoftBank’s investments dropped more than 70 percent in volume during the period.

However, in terms of value, Tiger Global invested about 70 percent less in 2022 from a year earlier as it cut its cheque sizes and participated in early-stage and Series A rounds. Moneycontrol reported how Tiger Global’s Series A participation jumped 80 percent in 2022 from 2021 in India, even as it dropped 11 percent globally.

To be sure, overall PE/VC funding has dropped more than 80 percent in January from the same month a year earlier amid macroeconomic headwinds. This has compelled many startups to aggressively cut costs. In the first 30 days of the new year, at least 15 startups have laid off close to 2,300 employees, according to data compiled by Moneycontrol.